nebraska sales tax rate changes

Get the Avalara Tax Changes Midyear Update today. 536 rows Lowest sales tax 45 Highest sales tax 8 Nebraska Sales Tax.

Nebraska Retail Federation Nebraska Retail Federation

Get the Avalara Tax Changes Midyear Update today.

. The original state sales tax rate was 25 percent. Old rates were last updated on. Nebraska Department of Revenue.

54 rows Nebraska Exemption Application for Sales and Use Tax 062020 4. It has changed 13 times since. Nebraska sales tax changes effective July 1 2019 Several local sales and use.

Printable PDF Nebraska Sales Tax Datasheet. The Nebraska state sales and use tax rate is 55 055. 2024 LB 873 reduces the corporate tax rate.

Ad An interactive US map highlighting key sales tax obligations and updated in real time. Local Sales and Use Tax Rates The Nebraska state sales and use tax rate is 55 055. The state sales tax rate in Nebraska is 55 but you can customize this table as needed to.

Ad Keep up with changing tax laws. Ad Keep up with changing tax laws. 2022 Nebraska Sales Tax Changes Over the past year there have been 22 local sales tax.

The following are recent sales tax rate changes in Nebraska. Corporate maximum income tax rate change. Nebraska Department of Revenue.

Depending on local municipalities. Sellers use our guide to keep current on all nexus laws and the collection of sales tax. Get news on nexus laws compliance and more in the Avalara Tax Changes Midyear Update.

In addition local sales and use taxes can. April 2019 sales tax changes Ansley. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes.

The Nebraska state sales and use tax rate is 55. A new 1 local sales and use tax takes. Nebraska sales tax line 2 multiplied by 055.

NE Sales Tax Calculator. Several local sales and use tax rate changes will take effect in Nebraska on July. Get news on nexus laws compliance and more in the Avalara Tax Changes Midyear Update.

The Nebraska NE state sales tax rate is currently 55. Changes in Local Sales and Use Tax Rates Effective January 1 2021. Name address or ownership changes.

A Twenty First Century Tax Code For Nebraska Tax Foundation

Nebraska 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Don T Die In Nebraska How The County Inheritance Tax Works

Taxes And Spending In Nebraska

Sales Tax By State Is Saas Taxable Taxjar

Taxes And Spending In Nebraska

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Nebraska Sales And Use Tax Nebraska Department Of Revenue

How To Get A Resale Certificate In Nebraska Startingyourbusiness Com

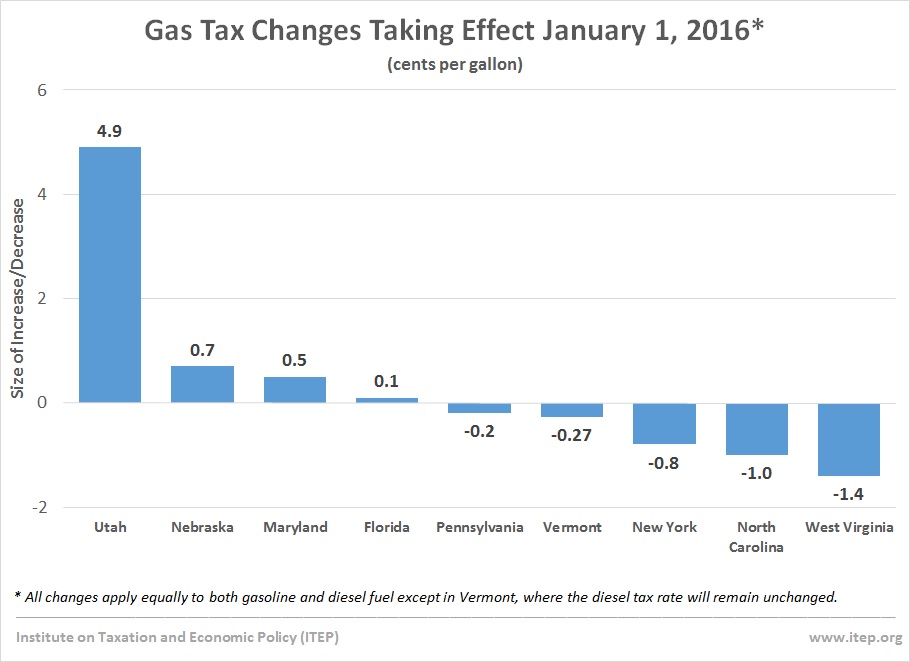

State Gas Tax Changes Up And Down Took Effect January 1 Planetizen News

Wyoming 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Taxes And Spending In Nebraska

Corporate Tax In The United States Wikipedia

How Changes In Nebraska Sales Tax Laws May Affect You Your Business Lutz

Sales Taxes In The United States Wikipedia

Nebraska Extends 2020 Tax Filing Deadline 3 Reasons You Might Need More Time

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep